Sometimes, instead of being cheeky, our Christmas elf leaves the kids a fun science investigation to try. The elf brings everything the children need for the experiment and printed instructions for them to follow to make it as simple as possible.

If your elf is looking for inspiration, they might like these elf-themed science experiments!

Elf Experiments Book

Grab your FREE elf experiments booklet from the link above.

Elf Themed Science Investigations

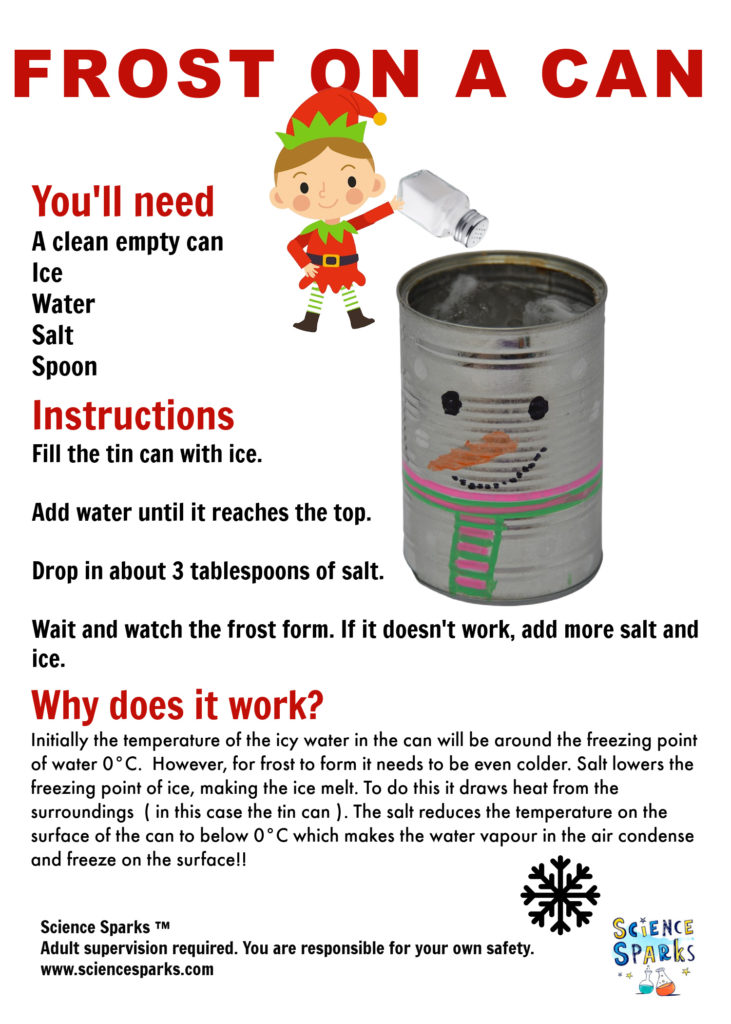

Frost on a Can

Make a Frosty the Snowman and learn about the cooling power of salt at the same time!

Frost forms on the outside of the can, making it look like a snowman! This activity works really well and usually creates a wow moment for children watching.

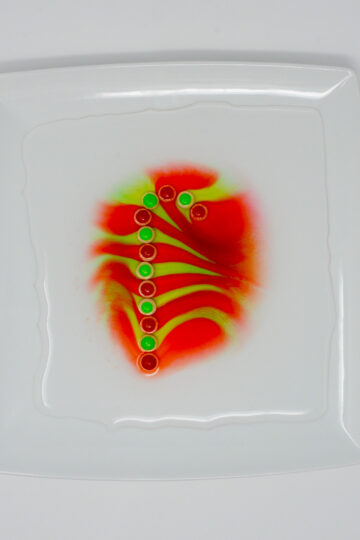

Skittles STEM

All you need is a bag of Skittles and water for this activity! Pour warm water over the Skittles and watch as the colours spread out.

If you have a white coffee filter or filter paper lying around, you could try some candy chromatography at the same time!

Expanding Sweets

This is another super easy activity that requires just a little bag of gummy sweets. Pop the candies in water and watch as they double in size!

Jumping Candy Canes

Make tissue paper candy canes jump with this easy static electricity investigation.

Experiment with different types, shapes and sizes of paper.

Optical Illusion

Make decorations appear on Christmas trees, eyes appear on a snowman, and anything else you fancy with this easy Christmas themed optical illusion.

Save the Elves

Build and test an elf raft to help an elf cross a river. Can you make it strong enough to hold the weight of a small gift or elf?

Hot Chocolate and Candy Canes

Is there anything more Christmassy than a minty hot chocolate?

In this activity, children time how long marshmallows or candy canes take to melt in a hot chocolate and discover what happens to a candy cane used as a stirrer.

Print the entire booklet of ELF Experiments!

More Elf Ideas

Add some crafts to the advent fun with these gorgeous elf cups from Fireflies and Mudpies.

Try my elf STEM challenges with FREE printable challenge cards.

Red Ted Art has a super cute moving elf puppet.

Rainy Day Mum has some elf ideas to share, too!

Last Updated on December 4, 2024 by Emma Vanstone

Mary STauffer says

Thanks for always providing so many great ideas. You save me hours in research and planning time!