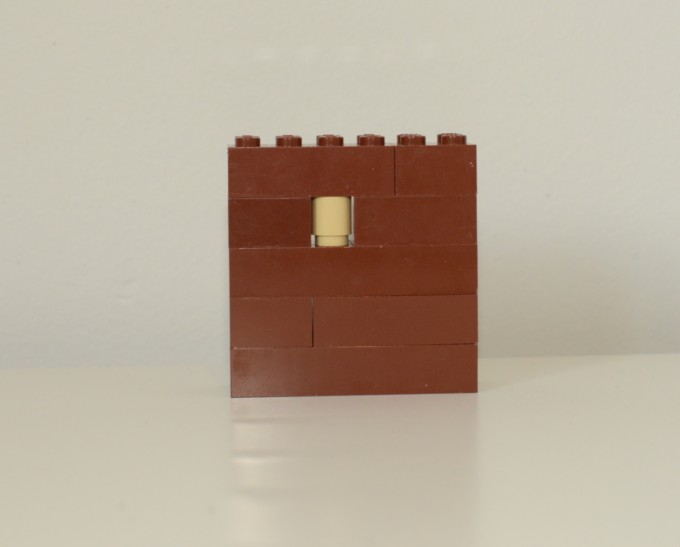

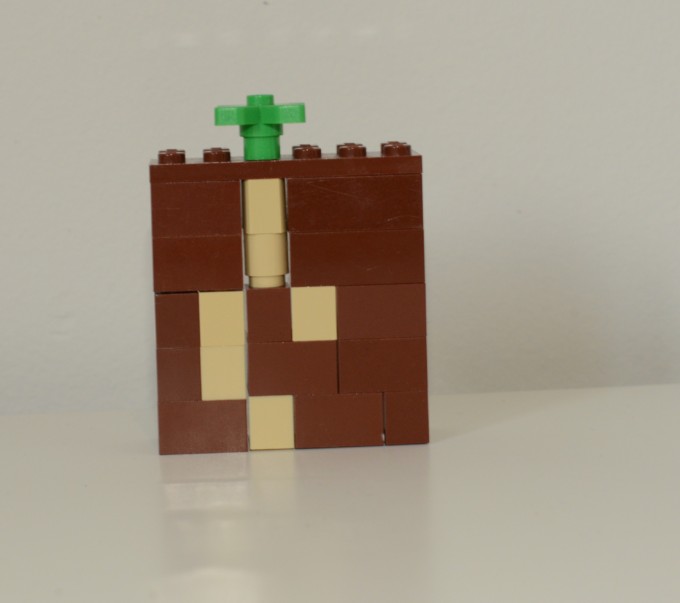

We made this easy LEGO model to demonstrate the changes that happen when a seed grows into a plant.

Lego plant growth model

A seed needs three things in order to germinate ( germinate means start to grow )

- Water - allows the seed to swell up and start to grow

- Oxygen - allows energy to be released for germination

- Warmth - germination improves as temperature rises

A plant needs light, warmth, nutrients from the soil and water to grow successfully. This model shows the roots starting to grow. Roots are needed to transport water and nutrients from the soil up the stem, and to support the plant in the soil, helping it stay upright.

You can see the beginnings of a stem here. The stem transports water and nutrients around the plant.

Leaves on a plant create energy for the plant by a process called photosynthesis.

What is photosynthesis?

Carbon dioxide + water (and light ) ———> glucose and oxygen

Why is photosynthesis important?

Photosynthesis is a very useful process as green plants take up carbon dioxide from the air and produce oxygen, which we need to stay alive. Without plants, we wouldn't have oxygen to breathe and animals would have nothing to eat, our food chain would collapse.

If a plant is kept in the dark it cannot make the green colour in the leaves ( chlorophyll ) so the leaves will turn yellow, you can see this with our cress caterpillar. A plant cannot make it's own food without sunlight, as Chlorophyll vital for photosynthesis

More fun plant science activities

Last Updated on June 30, 2025 by Emma Vanstone

Leave a Reply